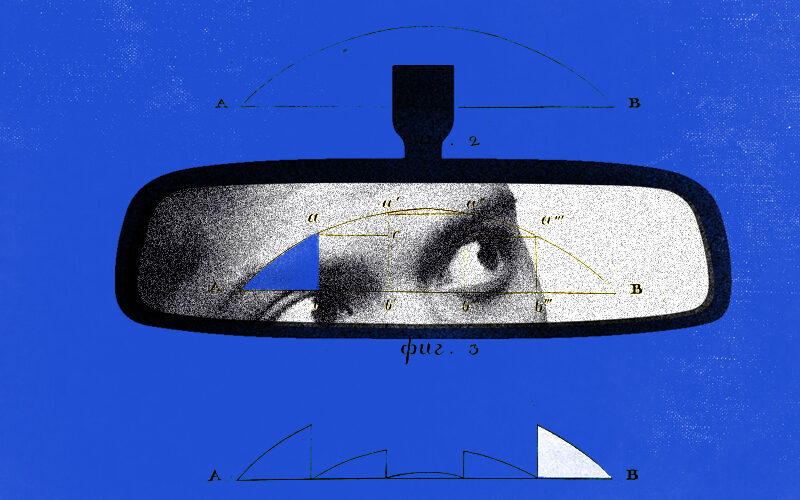

When you start to learn about them, life gets kind of terrifying. All the rational thinking and logical decision-making in the world can’t save you from the black hole of your brain’s bugs and blind spots.

Only the most self-aware can conquer them (and prevent the destruction of their startups because of them). Because biases run so rampant in our everyday lives as well as the business world, this is likely one of the most important articles you’re going to read as a startup founder.

Are you confident or overconfident?

Perhaps the most seductive trap our brain sets for us is confirmation bias. We love consolidating our beliefs. When we have ideas we believe will lead us to success, we look for reasons to convince ourselves that they’re good (and ignore signals they might be bad). This sense of security and self belief can be hugely comforting and completely devastating.

Confirmation bias completes a grouping of fallacies including:

- Overconfidence bias (the tendency to overestimate our abilities in comparison to others)

- The Dunning-Kruger effect (the more educated you are, the less confidence you have in your knowledge, and vice versa)

- The planning fallacy (we underestimate how long things will take, sometimes catastrophically)

- And the optimism bias (AKA blind optimism).

This box of cerebral tricks carries a dangerously high threat level for entrepreneurs.

Essentially, the smartest people know that they know nothing. We wildly overestimate our chances of success, even when we can see the mistakes being made by others doing the exact same thing.

The best line of defence is to plug that chasm of clarity with as much data, external feedback, and expert advice as possible. It’s been shown that the planning fallacy disappears when we’re evaluating other peoples’ ambitions. We’re much less surprised when other people’s endeavours fail than when we fail. So bring your co-founders’, colleagues’, and customers’ perspectives in as much as possible.

Halting the hivemind inside your startup

Encouraging rather than punishing dissent is key to avoiding another deadly cognitive bias: group think. As a start-up founder, you are susceptible to certain personality traps like emotional or evangelical leadership styles. Your drive, charisma, and status as founder makes those below you susceptible to authority bias, where they (potentially falsely) attribute greater accuracy to your opinion.

This leads to a situation where everyone in your organisation is saying the same thing, and potentially even thinking the same thing, whether it’s right or not.

Thanks to authority bias (and the hierarchical nature of capitalist structures), most people are naturally very hesitant to call you out if you’re wrong. It will require a concerted, culture-focused effort on your part to dissolve this natural fear of dissenting.

While you’re at it, keep a check on proximity bias, where employees you see or socialise with regularly are treated better than remote employees or those less chatty at the watercooler.

Ostrich bias will have you sticking your head in the sand when things get rough. Open conversations with your wider team will help you face up to intimidating issues.

Finally, in-group bias leads us to favour those we consider in our immediate circle (employees, shareholders, customers) over those outside it (freelancers, competitors, potential customers who went with a competitor). Evade the trap by applying the same culture-focused treatment to external employees, not “over-branding” your team with merch up to the eyeballs and cliquey vernacular, and keeping the door open for those lost customers rather than writing them off as “not our people”.

Halting the hivemind outside your startup

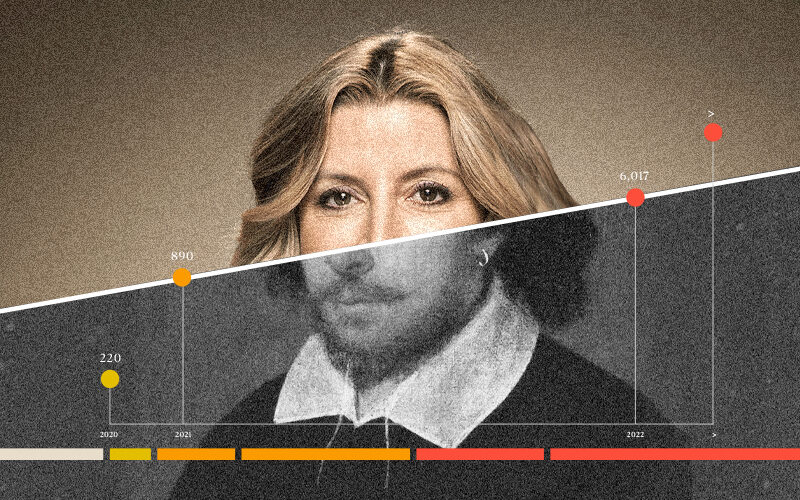

External to your organisation, you’ve got the bandwagon effect to worry about. It can be tempting for startups to jump onto trends, and for investors to funnel capital into them, often with an overestimation of demand (“everybody’s doing it”) rather than a solid business strategy.

Going after a trending market can lead to Red Ocean thinking – AKA pursuing an oversaturated market. Out-of-the-box thinking is becoming an extremely tired expression, but it’s the innovators not the followers who are catching the worm.

It’s also the innovators who face the biggest status quo bias resistance among their consumer groups. Status quo bias describes a preference for the norm. In the short term, it makes jumping on a bandwagon seem much more appealing, because you don’t need to disrupt consumers’ habits or make them try something new. But long term, fads fade. The trick is making your service the new status quo, which your customers will ultimately defend just as fiercely.

Throwing good money after bad

You’ll no doubt be familiar with sunk cost fallacy if you’ve ever traded on the stock market. The more time, money, or effort we’ve poured into something, the more likely we are to chase it into the negative. In romantic relationships, you’ll hear this manifesting as “we’ve just been together so long”. In renovation projects, you’ll hear people saying, “we’ve just spent so much money on the place”.

The only way to break it is to admit there’s no future to your endeavour – to walk away and accept the loss.

This also means conquering our loss aversion. We hate losing even more than we like winning. Softbank CEO Masayoshi Son famously funnelled another USD $11 billion into floundering coworking giant WeWork rather than taking a $9.5 billion loss, even after the IPO had failed. Don’t fall into the trap of mitigating loss rather than pursuing new ways to gain.

Similarly, risk aversion keeps us from taking the risks we need to progress, even the smallest ones. Zero-risk bias shows that we prefer reducing risks with a 5% chance to 0% over a 50% chance to 25%, even though the reduction (and potential pay off) is much greater.

Risk aversion is less of a factor with founders, who are by nature pursuing one of the riskiest professional choices possible. But it’s something you need to consider for your customers, for whom switching to your product may carry an element of risk. Finding ways to eliminate perceived risk for them will reduce the chances of this bias messing with your sales.

The fact that lottery numbers have just as much chance of repeating themselves from one week to the next as being a new random set is baffling to our gambler’s fallacy addled brains. We think that the more frequently things have happened, the less likely they’ll continue to happen.

This one can quickly lead to trouble for startup founders because it fosters delusional thinking. We lost the last three investor pitches, this next one’s gotta be the one, right?! Not necessarily. Don’t rely on delusions of probability or wait for “your time” to come – if something’s not sticking, assess and recalibrate.

Un-skewing your self-perception

Attribution bias (or fundamental attribution error) convinces us our failings are down to factors beyond our control, and others’ failings are because of some inherent character flaw. Basically, nothing’s our fault, but everything is other peoples’ fault.

Much like survivorship bias, which is so elemental to startup culture we gave it its own article, these fantasies shield us from recognising and learning from our errors and shortcomings. We see ourselves as victims of circumstance, and others as deserving of their fate. Remember: we’re all at the mercy of chance. You can do everything right and still fail.

Bonus biases for founders to beware

The availability heuristic dictates that we only draw data from scenarios near to us. A restaurant founder in a small, remote town will draw conclusions about the restaurant market from the experience of her handful of competitors. She might assume people in general are drinking less, spending more, or going off a certain food item because that’s what her peers are saying. Down the road, or across Australia in general, the reality is likely completely different.

As founders, we need consistent checks we’re not operating in echo chambers. Being aware of global markets and diversifying our teams are good places to start.

Anchoring is where a number given in early talks sticks in our mind. It’s useful in sales where dropping a disproportionately high number into conversation makes subsequent numbers sound lower. Beware of investors strategically suggesting an alarmingly low number early on to make subsequent offers sound higher.

The IKEA effect dictates that we love things more when we’ve made them ourselves. See IKEA furniture, Lego, Build-a-Bear teddies, and the classic case of Betty Crocker cake mixes. The takeaway for startups? The ease you’re offering can be too much of a good thing. Does your product suit the hyper-convenience model where everything is done for them? Or could you deliver more value by involving them more in the process?

If you reached the end of this article and thought “none of this sounds like me”, you may be suffering from blind spot bias – the presumption that you’re less susceptible to biases than others.

We all have biases, and we all succumb to them on a daily basis.

But if founders having cognitive biases automatically meant failure of their companies, there would be no commerce and no economy to speak of.

What tends to herald the downfall of founders and their startups is a) denying they’re vulnerable to these mental and emotional quirks and b) falling prey to one glaring cognitive bias time and time again.

It only takes one harmful repeated error to create a compound effect over the course of your decision making.

Knowing your weaknesses is always a strength. Surround yourself with people who aren’t afraid to call you out on them.

“We don’t see things as they are, we see them as we are.”

Anaïs Nin