To argue no one will adopt the blockchain-based web3 is like saying in 2001: “the internet will never catch on”. Eden Block partner Lior Messika has called it “the foundational layer of the Metaverse” and claims every investor who understands the concept is already “strapped in and ready to go”.

Web3 has landed, it’s received USD $21 billion in venture investments, and it’s not going anywhere fast.

What does a web3 future look like?

Web 3.0 incorporates cryptocurrency, big data, decentralised ledger technology, and machine learning to deliver us a bigger, better, shinier internet. It merges digital worlds with reality. It removes the “audience ownership” we see in online communities and creates a more realistic and personal online social experience.

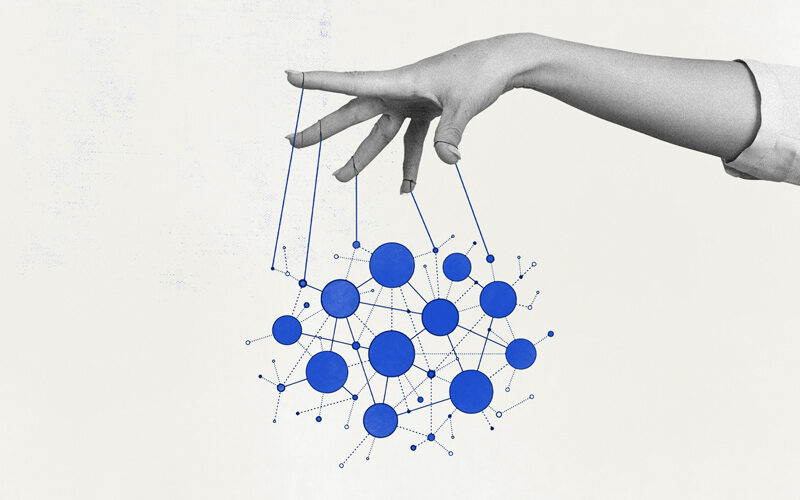

At the core is decentralisation. There will be no one central authoritative voice. Instead, networks and communities make the decisions. Sounds pretty socialist, right?

As with all innovations that threaten to overthrow the status quo, there is dissent.

There’s a conundrum for corporations and venture capitalists alike: web3 is decidedly anti-capitalist. But not to engage with it is to take a serious oppositional stance. Clinging onto the old centralised ways where data can be bought and privacy can be invaded will alienate them from growing consumer segments.

Who’s bullish on blockchain?

While some remain unsure, tech firms make obvious leaders in the charge.

GameStop has entered the community, having established an “NFTeam” and announced a partnership with Ethereum payment protocol Loopring. Alphabet has installed a blockchain team.

Twitter is looking at ways to integrate web3, despite the dissenting words of its former founder (more on that shortly). And web3 was a central theme in Spotify’s annual hackathon Hack Week, with the streaming service hiring for web3 related roles and allowing artists to sell their music as NFTs.

The notorious SP (Sean Parker) is bullish on blockchain’s potential for content creators and the wider media industry, based on the meaningful connections creators can build with fans and the fairer ways they can receive revenue.

Despite the nervousness, there is much activity in the VC space among the forward-thinkers. In February this year, Silver Lake and Lightspeed Ventures invested USD $200 million in web3 development company Alchemy. Sequoia Capital, Softbank, and Tiger Global invested USD $450 million in Ethereum scaling platform Polygon in the same week.

Silicon Valley firm Andreessen Horowitz has one of the longest crypto legacies in VC, having invested in Coinbase almost a decade ago. It’s raised a USD $4.45 billion fund for crypto and blockchain based contenders, and released an optimistic report on the state of crypto (despite the bear market).

Partner Arianna Simpson believes the sceptics of web 3 are “not where we are, which is in the fortunate position of being able to talk to these brilliant builders all day…. Many of the sceptics are the titans of Web 2.0… [who have been] in a position to profit from and benefit from the closed platforms.”

In 2021, blockchain startups raised an average of USD $20 million a day.

It’s all sounding pretty positive. But in the words of Tim O’Reilly, “It’s very hard to convince somebody of a thing when financial gains depend on them believing in it.” Are we just naive consumers of repackaged capitalism?

Who’s against it?

Web3 is still an unproven concept. Some even see it as a marketing stunt. And some see it as a rebrand of relentless capitalism.

In Jack Dorsey’s words, “You don’t own web3. The VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralised entity with a different label. Know what you’re getting into.”

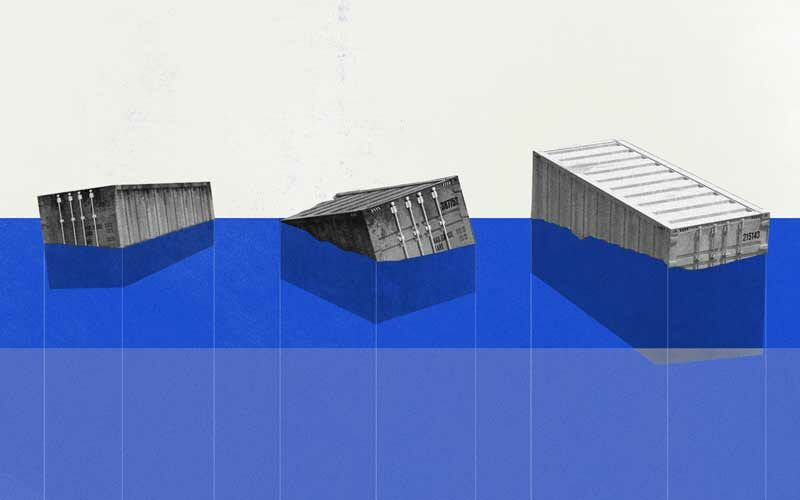

He isn’t alone. Industry folk circling the Metaverse/web3 scene suspect it isn’t what it seems. Some call it a “hype bubble”, comparing it to previous waves of interest in the blockchain.

Some think although people are buying into it, they’re still using all the major, mainstream tech platforms. There are people buying NFTs, but they’re doing it ironically. They’re buying $100 worth of Ethereum, but they’re doing it tokenistically.

Perhaps more problematically, they’re not necessarily trading it either. The volatility is still too appealing. Why spend 3 Bitcoin (equivalent of AUD $120,000) on a Tesla when its value could jump the following quarter?

VCs vs. Web3

The more open-minded among VC firms are forging ahead with web3 investments. Is it to project an image of rebellion against traditional financial power structures? Or do they genuinely see value in the space?

Under capitalism, centralisation is unavoidable. A fair and equitable allocation of power is impossible. Web3 is an attempt to solve this, but a marketisation of power is already manifesting in the distribution of wealth for assets like Bitcoin and NFTs.

Look at “land” ownership in the Metaverse. “Plots” are “worth” millions (forgive the quotation marks). The 99% was priced out before they could blink. The new online reality for all has immediately become a playground for mega corporations (Adidas and Warner Group have invested – in what will inevitably be billboard space) and millionaires to turn money into more money.

PwC’s head of crypto Henri Arslanian has reported that VCs are increasingly “curtailing opportunities for smaller, often family-run firms to invest and participate in the growth of promising crypto start-ups”.

PwC happens to own a plot in The Sandbox, one of the four suburban dimensions of the Metaverse, where it’s creating “a Web 3.0 advisory hub to facilitate a new generation of professional services, including accounting and taxation”. Thrilling stuff.

But the Metaverse not only offers “immersive brand experiences” and new ways to interact online – it’s an avenue into web3 startup land. Investors love Next Big Thing status. Showing they “get it” will give investors an edge with the next web3-native startup to 10x.

While they may want us to think they’re choosing this zany and revolutionary investment route, profit remains at the core. Getting ahead of the curve is a good look, but the intention remains for many to stake a share of the spoils in a potential ‘to the moon’ marketplace.

Maybe there’s a middle ground

It would be naive to expect anyone in the financial ecosystem to pursue something without profit as a driver. We still need to exchange tokens for goods and services – whether those tokens are dollars or Dogecoin.

The vision of web3 isn’t to radicalise us out of the token exchange format we’ve lived with for 5,000 years. It’s to pair it with something more equitable, more transparent, and more trackable.

The aptly named Eden Block says of the blockchain-based era: “The core drivers for web3 are values-based and financially driven – thus, iterating on web3 will be a cultural and capitalistic mission. It will be incentivized by numbers, algorithms and code, and it will also be supercharged by brand, community and people.”

Decentralisation as a concept offers an insight into a societal shift, rather than a revolution.

And if 2001 is anything to go by, if there’s a massive shift brewing enabled by a mysterious new technology, it’s probably coming for us all in the end.