Even the most fledgling founders will have come across many acronyms in their short startup lives.

Some are almost too dry to comprehend. Some sound so similar to others it feels impossible to know which to use.

But metrics are unfortunately unavoidable in tracking progress, pursuing success, and securing funding for your SaaS startup.

The good news is, SaaS is all digital. Like how Buddhism teaches that all you need is within you, all of the data you need to inform your metrics is already within your startup.

You just need to choose the metrics that are most appropriate for charting your growth.

Each metric defined here could form an entire article in itself. This is something of a crash course. But even in your very early seed stages, these are the metrics you should be getting very familiar with, and deploying them in strategic pursuit of your overarching goals.

Growing the numbers

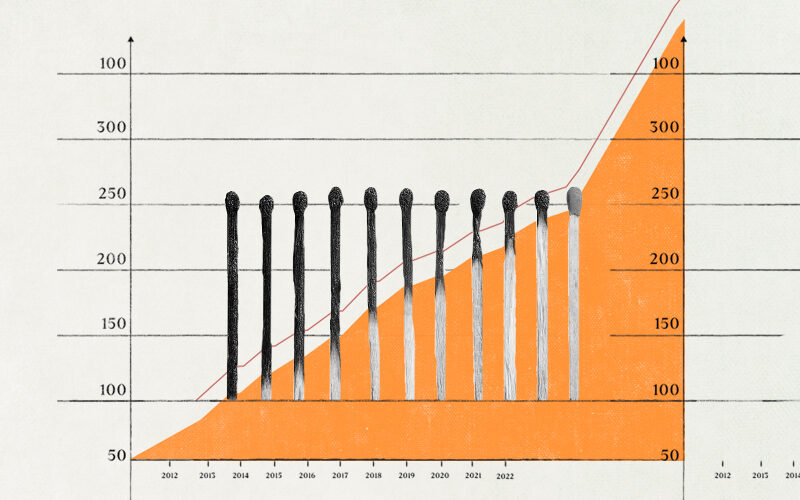

If you want to hit a target number of subscriptions, you can use Monthly Recurring Revenue (MRR) or Annually Recurring Revenue (ARR) to measure success. It’s entirely based on repeat business – no counting one-time payments.

The key components are:

- Retained – revenue generated by existing customers

- Expanded – revenue added by existing customers

- New Sales – as it says on the tin: revenue generated from new customers

- Resurrected – revenue made from former customers who have returned

- Contracted – revenue lost from downgrading

- Churned – revenue lost from churned, or lost, customers

Keeping the numbers

Retention is measured by grouping customers according to how long they’ve been using your SaaS. You can focus on:

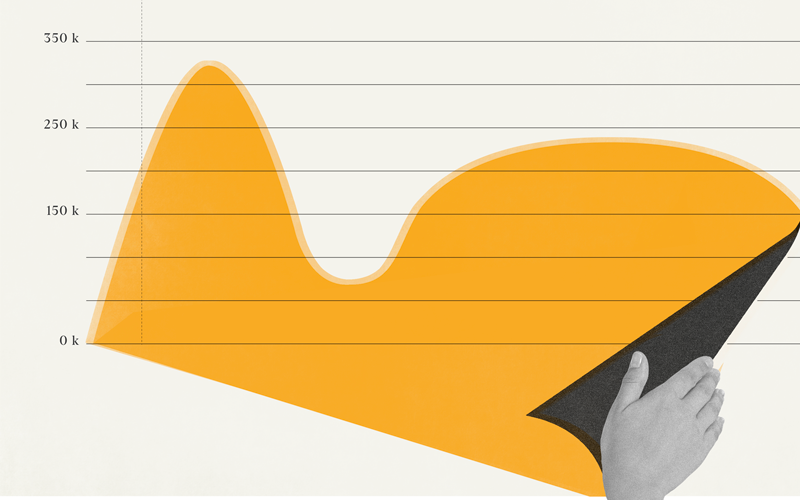

Dollar retention – the measure of revenue a customer provides relative to its original size, also known as Net Revenue Retention (NRR). If this metric dips below 100%, you have a leaky bucket (outsized customer loss) on your hands.

Logo retention – a measure of the number of recurring, active, non-churned customers. 95% is an excellent number for this. Anything below 70% again signals a leaky bucket.

Efficient numbers

This is the category that helps you avoid misleading spikes and false growth.

The main two efficiency metrics to consider are sales efficiency (achieving sustainable growth) and capital efficiency (how much you’re reinvesting into growth).

New Sales ARR – helps you avoid basing your forecasts on growth you might’ve achieved through uneconomic or unsustainable spending (e.g. big marketing campaigns). Here, you’ll compare New Sales ARR against sales and marketing expenses.

CAC – Customer Acquisition Cost is a nice simple one. It divides sales and marketing expenses by the number of newly acquired customers. The former comes from your last quarter, the latter from your current quarter to reflect the time it takes for marketing efforts to materialise.

You can also compare your new customers’ ACV – Annual Contract Value – to their CAC, which ideally will be greater (meaning customer acquisition doesn’t cost more than first year’s revenue).

CAC Payback – helps you determine how long it takes for a customer to produce enough gross profit to pay back their cost of acquisition. This will help you set your sales cycles. To find it, divide sales and marketing spend by (MRR x Gross Margin).

Burn Multiple – your net cash burn divided by Net New Sales ARR in a given period. This is another simple metric that reveals how much you’re burning in exchange for each dollar of ARR, with a lower Burn Multiple signalling more efficient growth.

Hype Ratio – a new-school metric in which your capital raised is divided by ARR. Where Burn Multiple focuses on recent performance, Hype Ratio seeks to calculate the potential halo-effect value that hype achieved through whatever marketing efforts will bring to your startup.

Tracking engagement

DAU/MAU/WAU – your ratio of Daily Active Users to Monthly or Weekly Active Users. 40% is a good DAU/MAU ratio in SaaS, as this means your typical B2B user is logging into your software at least two days out of the week.

60% (translating to 3 out of 5 weekdays) is a good benchmark if you’re opting for DAU/WAU. Naturally, around the time of national holidays, you’ll see these ratios dip.

Minding your margins

Gross Margin – a business 101 principle, GM reflects your profit after subtracting the cost of goods sold (COGS) from your revenue. What constitutes a “good” margin varies across industries, but in SaaS, 75% is a good number.

Lower than this and you may have a Mechanical Turk problem (you’re using people to perform the product capabilities, who are more expensive to run than software).

LTV – Lifetime Value is the total gross profit you’ll get from your average customer, minus their acquisition cost. LTV should also incorporate Dollar Retention and Gross Margin to reflect overall startup health. A Dollar Retention rate over 100% means your LTV can increase indefinitely, but if you’re losing customers, your LTV curve will flatten.

Lean Analytics tells us that “a good metric is comparative, understandable, a ratio or rate, and changes how you behave”.

The biggest downside of metrics isn’t their sheer dryness – it’s that they bring black and white numbers into screaming reality, sometimes blowing your assumptions about what was working clean out of the water.

Be honest about your biases, figure out what’s actionable, and use the data to either pivot or persevere.

If your metrics aren’t changing how you behave, you’re not using them right.