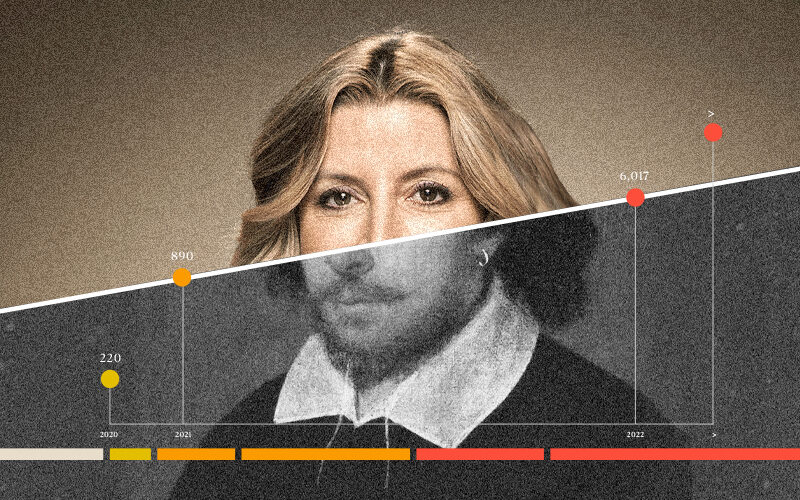

Over 472,000 businesses were started in Australia in 2022.

Of the 40% that make it through the first 3 years, less than 1% will secure VC funding.

The tiny percentage of those that make it through the looking glass fuels the mystique and exclusivity of the sector. It’s what makes it such a coveted prize and a tunnel-visioned pursuit for many entrepreneurs – so much so that, once they secure it, many fall to the fallacy that securing VC cash = automatic success.

What is it about that 1% attracts the benevolence of venture capitalists? More to the point, why do VCs tend to turn their noses up at 99% of perfectly profitable business opportunities?

One theory is that, like many startup founders, VCs are only interested if they get a chance to change the world.

Lifestyle vs. startup

To define a VC-worthy startup you’re looking at punchy words like mission-based! Disruptive! Defensible!

As most in the space will know, lifestyle businesses aren’t gym wear startups, coffee houses, or champagne brands. They’re about your lifestyle – or building something that lets you lead a comfortable one. Lucrative, yet balanced.

The motto is “think small”. Stay local, or national. The clue is in the name: to still have a life.

They might be bootstrapped, FFF funded, or in some cases angel backed. Some lifestyle founders might start off under the illusion that VC is the eventual goal, but end up doing just fine and enjoying long term, lucrative success with revenue-based financing.

If they do take the angel route, they might seek periodic cash injections of $100,000 to $500,000. There’s less pressure to double in value with each series.

A lifestyle founder might be at the helm of their businesses for many years. A startup founder might sell up after five.

They could still make millions. But not billions.

That said, they might be able to enjoy the cash they pull in rather than having it tied up in stock.

The anti-hustle

There are less flattering descriptions of lifestyle business founders.

Namely: “an entire generation of entrepreneurs building dipshit companies and hoping that they sell to Google for $25 million”.

There’s a certain snobbery about them – albeit one that’s rapidly becoming outdated – thanks to the glorification of grind culture.

The absence of the risk it all, fly or fall mentality makes lifestyle businesses somewhat less romantic. To what might be the horror of out-and-out startup founders, they’re what you might call… sensible.

But when you don’t have to give away big chunks of equity, being sensible is maybe not such a bad thing.

VCs rarely touch anything approaching lifestyle – but it’s nothing personal. In the words of Allied VC founder Matt Wilson: “VCs have a very specific and unique set of mandatory criteria when evaluating possible investment opportunities… [and] the vast majority of businesses simply do not fall into this bucket.”

So what are those mandatory criteria?

Namely: execution, scale, growth.

Lots of people have great ideas, very few people get around to building them. You’ve got to have a mission, a vision, and the facility to execute them to attract VC appetite.

You’ve gotta be able to scale, ideally globally. Delivering the outsized returns VCs are looking for (100x) within the standard timeframes (7-10 years) calls for the weight of multiple international markets.

For a venture-scale startup, growth should 2x or 3x year on year. You must be able to weather the pressure to burn cash, hit milestones, and grow aggressively.

If that makes you feel queasy, you might better suit a lifestyle business. If it only spurs you on, there might be something wrong with you you just might be a perfect fit for startup founding.

Lifestyle or life changing?

Australia’s venture capital sector remains “less than half the size of the OECD average”. We rank last for university tech transfer.

On a national level, we need prolific VC investment to fuel the startups that will create jobs, commercialise research, transform industry, and innovate our way into a new-era knowledge economy.

We need it to make connections, cultivate skill, inject capital into new technologies, and take the necessary risks to grow the sector to a size that better matches our bold ambition as a nation.

On a personal level, getting VC funding is really cool. It will open the door to truly great things. But only if it’s right for you.

Found a lifestyle business if you want to go down the pub after work. Found a startup if you want to go down in history.