So you moved from a conversation over coffee to a concept to an MVP.

You’ve mastered the fickle world of feedback, you’re iterating, you’re seeding investment. You’ve got buy-in, you’ve got traction. Suddenly, there’s a jump in customers/subscribers/sales.

You’re in your first growth spurt, and failure seems like a distant, laughable dream.

But for 70% of startups at growth stage, it becomes a horrible reality.

How to be the 30%

Growth stages for many founders boil down to start up > get big > get bigger. But if you can assess and pinpoint where you are, you can figure out where to go.

Depending on who you ask and how much you want to break it down, there are 4 to 8 distinct stages of growth to plot your progress against. Roughly:

1. Development: Business planning, strategising, goal setting, identifying product-market fit.

2. Startup: Testing, pivoting, expanding your team, and (crucially) fundraising.

3. Growth: ???

4. Expansion: Expanding the team, expanding operations, increasing market share, new rounds of investment, potentially merging or acquiring.

5. Maturity: Owning significant market share, increasing focus on retention, possibly rebranding, possibly merging or getting acquired.

You’ll note the definition of the growth stage is ‘???’ – and that’s because it’s not necessarily followed by ‘profit’.

This point in your timeline could be as high as the roller coaster climbs, or the warm-up curve before the big peak. It will be a time of cash influx, staff shortage (or over-staffing), scalability challenges, potential unfulfillment due to constraints, and potential customer turmoil.

Why you might be the 70%

38% of startups who fail at growth stage simply run out of runway. It’s the single most common cause of death, and it’s often a tragic one, because it can signal a failure to fundraise rather than a failure to make something good and worthwhile.

35% don’t even reach growth stage because they didn’t do their homework (or did it and ignored it) at development stage, and there was no market demand for the product. Next up:

- 20% are taken down by the competition

- 19% have fundamental flaws in their business models

- 18% face insurmountable legal issues

- 15% get their pricing wrong

- 14% are felled by personnel issues

- and 10% mistime the market.

If you’ve made it to growth stage, it’s likely you’ve swerved becoming one of those statistics. Now, you’re more likely to fail due to a stubborn refusal to pivot or respond to unexpected conditions.

Farmer’s Fridge gives us a nice example of the pros of pivoting. Their health food vending machines were doing well in airports, universities, and hospitals, until all of those venues emptied in the villainous year of 2020.

Founders took the challenge head-on and pivoted to D2C. They followed the fail fast philosophy. In engineer Brett Geschke’s words:

There wasn’t an expectation we were going to get it perfect right away. Instead, we were going to get this out the door, deliver our product to friends and family, and constantly iterate.

FF focused on proving new delivery models, developing the ordering platform, and understanding the changes in KPIs. It also engendered a friendly company culture where it was okay to test, fail, and try again.

Another fail trigger founders don’t see coming is too much cash.

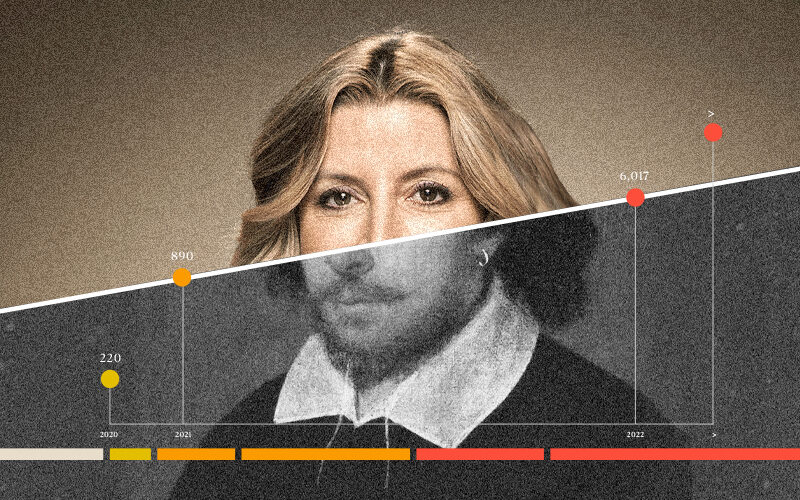

Quizlet was an early flash card-based edtech startup founded in 2005 by a 15 year old studying for his French exams. Andrew Sutherland bootstrapped Quizlet for a decade (if you can even call it a startup after 10 years). What started as a personal project slash side hustle was profitable by 2009 thanks to a paid subscription model. By 2014, it had 40 million users. And in 2020, it was valued at USD $1 billion.

We might call that playing the long game. Current CEO Matthew Glotzbach calls it “running the business like a camel” rather than a unicorn.

Glotzbach said: “I actually believe that had Quizlet raised a large amount of money earlier in its life cycle it may not have made it. The risk of getting overextended with high expectations… might not have accelerate[d] the business fast enough to meet [them]…. We would have over-promised and under-delivered.”

Quizlet is the ultimate example of slow, cautious, sustainable expansion. The COVID-19 pandemic brought a 300% growth spurt to the user base, but Glotzbach has not yet acted on that data, treating it as an anomaly rather than a reliable future prediction.

A couple more pitfalls to avoid are:

Forgetting your old customers for your new ones. In the words of GrowthX founder Sean Sheppard, “The last S in SaaS stands for service”. Whilst you’re driving towards acquisition, don’t neglect retention.

Buckaroo’ing the trends. You can buck a trend without veering wildly away from the status quo. Trends exist for a reason. Trying to do everything differently – rather than one or two things uniquely – can alienate majority audiences.

Burning yourself out. We talk a lot about founder flameout. The denial is real among hard working leaders, but it accounts for 5% of failures, so don’t think it’ll never happen to you.

And back to aiming for that 30%:

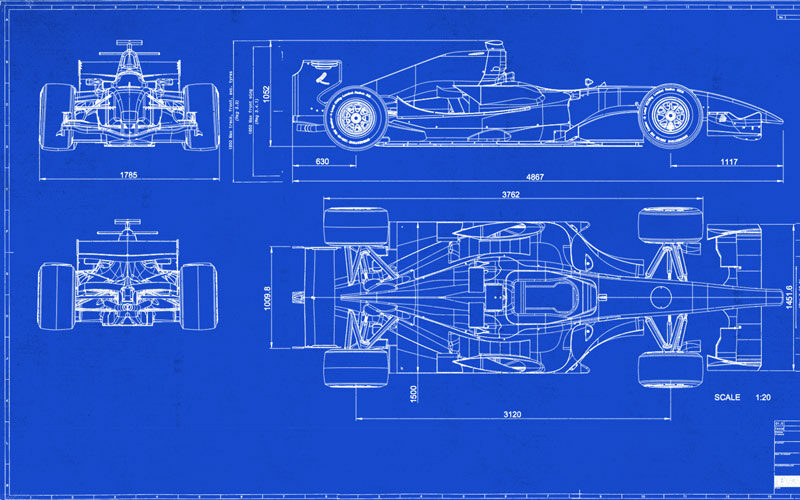

Sweat the small stuff. Invest in training, automate where possible, diversify your offering, and perpetually analyse your business like an F1 car.

Know your value. Blitzscalers rely on intro offers, giveaways, and endless promotion. Strong and sustainable businesses can’t cope with that kind of burn rate for long. Set your price early and deliver on the value it promises.

Finally, think camels, not unicorns. Like Matthew Glotzbach, prepare for long, dry spells rather than burning through your resources in anticipation of a mystical event.