In response to the crushing pressure of Wall Street’s expectations, companies are set up for a spectrum of dishonesty from the off.

On one end is unrealistic optimism, and well-intentioned but ultimately undeliverable promises. In the middle is a good old bit of bluster – white lies and embellishments that may or may not be fulfillable in the long term.

On the other end is fraud.

Deliberately inflating metrics to sell investors on the big plan can take many forms. Overstating customer acquisition costs, overreporting active users, only showing windows to investors where peak growth occurs, as well as a hundred other small sleights of hand that can become not so small in a court of law (or in the eyes of the investors who took a chance on you).

Either end of the spectrum can lead to disaster. The good thing (for new founders, at least) is that there are many, many cautionary tales to keep us on the right course.

Chirping too loudly

Let’s start with the big leagues. The infamous USD $44 billion deal between Tesla CEO Elon Musk and Twitter has reached an impasse. Despite Twitter claiming that only 5% of monetised users are fake/spam accounts, Musk is guessing that number is higher than 20%.

There’s been some talk of Elon craftily using this beef as a price-lowering tactic, but if he’s right, it could mean that Twitter was deflating its fake user numbers to make it more sellable (and more attractive to advertisers).

Obviously, this isn’t working. If warping those metrics causes headaches in big business, it will surely do the same with yours.

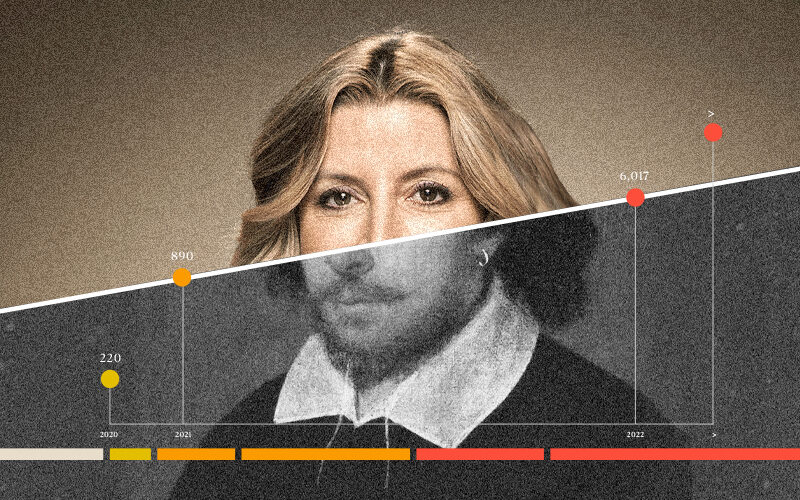

The obfuscation poster children

Elizabeth Holmes was found guilty in January of four counts of fraud (out of eleven charges). The charges were ‘conspiracy to defraud investors, and three counts of wire fraud against investors’.

Holmes went far beyond what could be chalked up to subtle embellishments – she fits pretty firmly into the “committing fraud on purpose” end of the spectrum. Theranos’ portable blood tester was never viable, and the company buried its own evidential tests proving this. In what we’ll come to see as rare for fraudulent founders, Holmes will likely spend time in prison.

A recent WeWork documentary shows multiple clips of founder Adam Neumann both evading and outright lying in response to news anchors’ questions of the company’s profitability.

But he walked away from the blazing wreck of his ambition with $1 billion. No criminal or regulatory charges were filed. And media outlets are even being forced to back down from their “defamatory” wording, with HBO removing the words ‘true crime’ from the documentary’s description.

‘A cult of Ryan’

In a saga as bold as it was strategic, online payments broker Bolt has been found to “utterly fail to deliver on the technological capabilities that it held itself out as possessing”.

The irony that Bolt provided a fraud detection service was almost certainly not lost on the investors who handed over a collective $1 billion.

Founder Ryan Breslow was said to lead a “cult of Ryan” with the charm and exuberance that reeled his investors in. The badly aging stereotype of the silver-tongued startup founder is still presenting an irresistible pull to Silicon Valley investors.

It’s probably less that they’re charmed by personality – after all, these are astute business veterans who make their living weeding out the time wasters from the next tech titans.

It’s FOMO, pure and simple. No one wants to miss out on the next Apple, the next Uber, the next Afterpay. So they throw their funds after the most audacious, ambitious entrepreneurs out there over the more sensible, quietly hardworking, transparent ones.

Spinning the truth

Another out-and-out fraud case was the SaaS platform HeadSpin.

Cofounder and CEO Manish Lachwani reported false ARR and broader revenue from customers who never completed purchases and who had left the platform. There was no CFO – Lachwani handled all of the finances. He went as far as to falsify the contracts and invoices he sent to his bookkeeper.

Lachwani achieved unicorn status after two funding rounds by virtue of his inflated metrics. The company had to pay back 70% of investment funds with 1% interest, and Lachwani (in what seems like a pretty minimal punishment) had to resign. He narrowly avoided prison.

Yogome

It’s not just the more glamorous sectors like tech, biotech, and finance that are fudging the numbers.

Mexican educational gaming startup Yogome (which operated out of San Francisco) was abruptly shut down in 2018 due to financial misconduct. The closure came just months after raising $36 million in venture capital.

Juan González, director of Innovation and Entrepreneurship at the Universidad Panamericana in Mexico, said: “Cases like these go beyond the entrepreneurial ecosystem of a country. It shows a lack of control and corporate governance from the entrepreneur when they forget that the mission, management and value given to investors should come from a legal framework.”

But with a stark absence of legal repercussions, it seems these cases serve more as a warning to investors than to founders. It’s perhaps this dizzying lack of consequence that allows fraud in the industry to proliferate. Or maybe it’s the growing understanding you can do everything “right” and still fail.

No shortcuts

Metric inflation might seem like a short cut to success. A placeholder until the metrics actually get to where you want them to be. Which they will, right? You just need more time!

The problem is that in the case it all comes out, failure will be much more spectacular – with much more damning consequences – than if you failed honestly.

It’s okay to present disappointing metrics as long as you have a reason behind them and a plan of action for improving them. Transparency keeps investors feeling secure and in control. And keeping them onside and invested in you personally is the most valuable course of action.